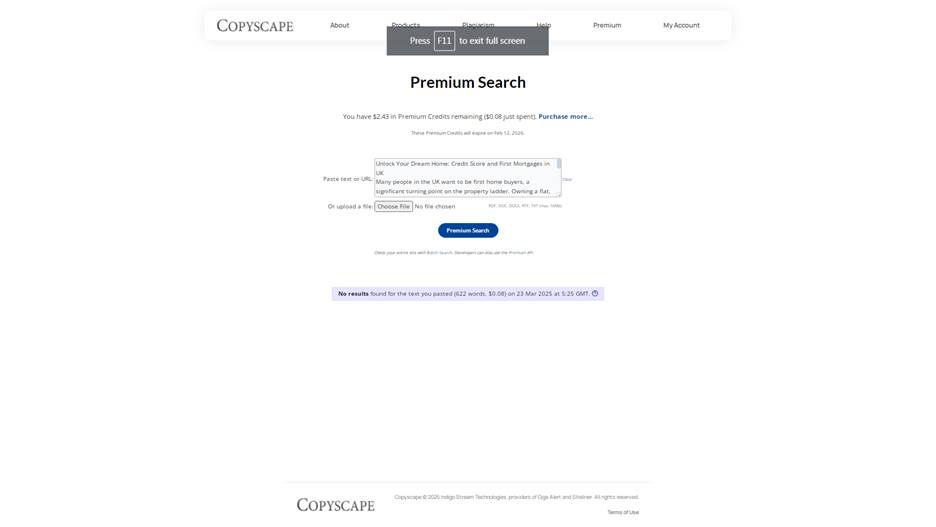

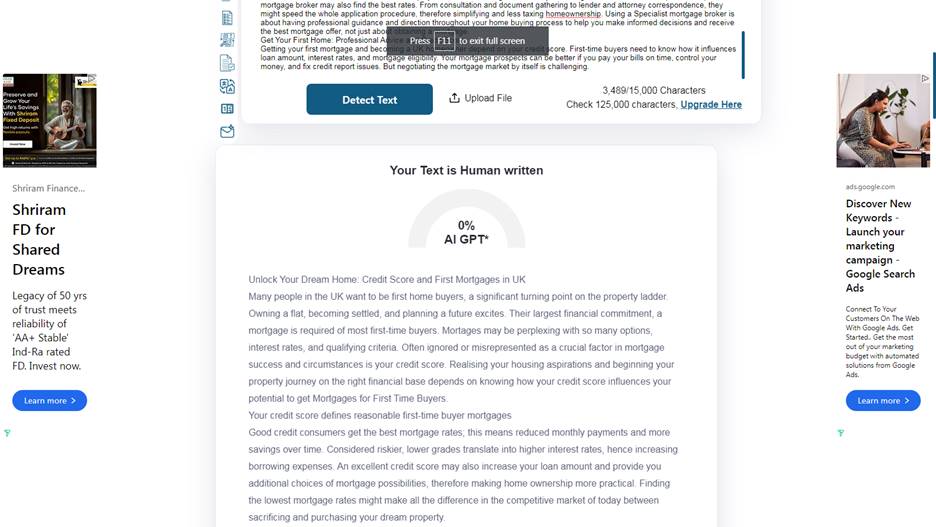

Many people in the UK want to be first home buyers, a significant turning point on the property ladder. Owning a flat, becoming settled, and planning a future excites. Their largest financial commitment, a mortgage is required of most first-time buyers. Mortages may be perplexing with so many options, interest rates, and qualifying criteria. Often ignored or misrepresented as a crucial factor in mortgage success and circumstances is your credit score. Realising your housing aspirations and beginning your property journey on the right financial base depends on knowing how your credit score influences your potential to get Mortgages for First Time Buyers.

Your credit score defines reasonable first-time buyer mortgages

Good credit consumers get the best mortgage rates; this means reduced monthly payments and more savings over time. Considered riskier, lower grades translate into higher interest rates, hence increasing borrowing expenses. An excellent credit score may also increase your loan amount and provide you additional choices of mortgage possibilities, therefore making home ownership more practical. Finding the lowest mortgage rates might make all the difference in the competitive market of today between sacrificing and purchasing your dream property.

Deciphering Credit Scores: Lender Factors

High credit use, almost maxing out your cards, might lower your score and point to financial trouble. Still another factor is credit history length. One wants a long history of prudent credit management. Though in the past or student debts repaid, a variety of credit—including credit cards, loans, and Mortgages for professionals—may be preferable than relying only on one. County Court Judgements (CCJs) and bankruptcy might seriously lower your mortgage possibilities and credit score. Professional and mortgages for self employed depend on a solid credit score, hence even if income and job consistency are equally vital.

Professional Guideline on First-Term Mortgages

mortgage brokers, especially those offering First Time Buyer mortgages,know the particular needs of first-time homeowners. Your credit score and financial situation will determine your tailored advice. Self-employed persons have complex income structures, which makes it challenging to get suitable mortgages. A specialist mortgage adviser can assist you to present your application in the best possible light and locate lenders more amenable to self-employed individuals. Using their industry knowledge and lender relationships, an independent mortgage broker may also find the best rates. From consultation and document gathering to lender and attorney correspondence, they might speed the whole application procedure, therefore simplifying and less taxing homeownership. Using a Specialist mortgage broker is about having professional guidance and direction throughout your home buying process to help you make informed decisions and receive the best mortgage offer, not just about obtaining a mortgage.

Get Your First Home: Professional Advice and Credit Score

Getting your first mortgage and becoming a UK homeowner depend on your credit score. First-time buyers need to know how it influences loan amount, interest rates, and mortgage eligibility. Your mortgage prospects can be better if you pay your bills on time, control your money, and fix credit report issues. But negotiating the mortgage market by itself is challenging.

Comments